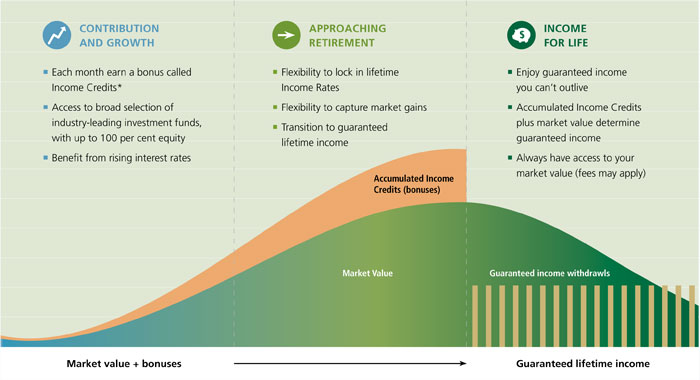

The first retirement management solution of its kind, Manulife RetirementPlus is an innovative, flexible savings product that can support you through the key phases of preparing for retirement – from saving to enjoying income.

1. Savings Phase

Helps grow savings and enhance future income potential

■ Choose from a broad selection of industry-leading

■ Benefit from a unique product feature called Income Credits to increase the value of your future guaranteed income beyond what’s possible through market participation alone

■ Benefit from potentially rising interest rates, which can increase your Income Credits

2. Preservation Phase

Determines future guaranteed income

■ When you’re ready, secure Income Rates to determine your future guaranteed income2

■ This is done by transitioning market value out of the Savings Phase and into a single fixed income fund

■ Not all assets need to be moved at once, but can be transitioned over months or years; this allows you to:

– continue accumulating Income Credits in the Savings Phase

– capture potentially rising Income Rates for future transitions if interest rates rise3

■ You can increase your future guaranteed income by delaying income payments

3. Income Phase

Offers flexibility to help support your retirement lifestyle

■ You can elect to receive lifetime, guaranteed retirement income from the assets that you’ve moved out of the Savings Phase

■ You have the flexibility to continue making deposits and accumulating Income Credits in the Savings Phase while taking income, so your future income can continue to grow

■ This flexibility allows you to choose either a partial or full income stream to support your unique

English

English Japanese

Japanese